Which Subscription Payment Service Should A Bootstrapping SaaS Choose?

When I was launching my first SaaS product one of the things that confused me the most were subscription payment services. There seemed to be so many, and their landing pages were of no help - they were more or less interchangable. I had so many questions.

Why can’t I sign up for Stripe in my country? Why can I sign up for Paddle? Other than that, what’s the point of Paddle if it’s more expensive than Stripe? How do you deal with all of these different countries and their VAT rules? Can I switch my solution later?

I did my grueling research and I wrote it down here.

Merchant of Record vs Payment Gateway

It turns out that you can’t compare Paddle with Stripe, they’re in different categories.

Stripe and Braintree are Payment Gateways. They let you get money from credit cards and leave the rest to you, including retries, charge backs, VAT and invoices. The customer buys directly from you.

Paddle and FastSpring are Merchants of Record. They resell your product and handle everything including taxes and invoices and you get one wire transfer once a month with your earnings, minus their cut. You don’t have any customers, they do.

For a more detailed explanation see What is a merchant of record.

Chargebee and Chargify are something else altogether - they just manage your subscription and billing logic. They’re useless by themselves, you need to connect them to a payment gateway.

A Paddle employee was asked how they compare with Chargebee, here is their response:

we have the tools you need for billing in one platform so you don’t need to worry about building a billing stacks (Stripe + Paypal + Chargebee + Avalara + Maxmind + Transferwise+ etc)

Payment Gateway

They’re cheaper and more flexible, but as one indie hacker put it:

Stripe is obviously great and super flexible, but then you’re stuck with tax reporting.

Want to do business in the EU? You have to handle each country’s VAT rules separately. Oh, and they keep changing.

Want to do business in India? You need to register before you do any business and you need a tax representative. Not doing that means you are essentially breaking the law.

Use a payment gateway if you only do business domestically or if your product is very expensive and your customers are few.

Merchant of Record

With a merchant of record you can instantly support the whole world. If you compare the prices Paddle is 2 percentage points more expensive than Stripe. But if you do a quick calculation it means that if only one in every 50 of your customers are from, say, India you’re making a profit.

To quote a different indie hacker:

Paddle works very well for me. I’m from the EU and I don’t have to worry about all these VAT regulations - a big advantage for me.

Despite the 5% commission, I saved a lot on accounting.

For a bootstrapper the sales/VAT tax is a killer and there is no way around it. Use a merchant of record if you’re boostrapping a SaaS.

Paddle vs FastSpring

And there are only these two to choose from.

Sure, support quality, documentation and the API matter. But these are technical problems and these you can solve. So let’s look at the business problems.

FastSpring - what the customer sees

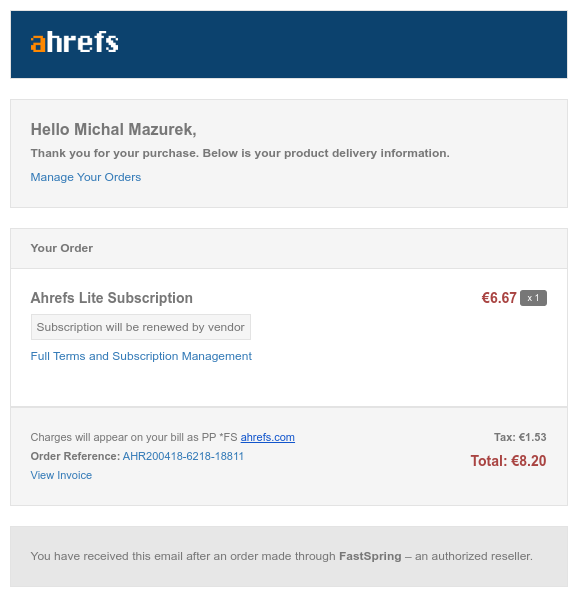

One notable FastSpring customer is Ahrefs: This is what I saw when I purchased a subscription.

What I saw when I purchased an Ahrefs.com trial

What I saw when I purchased an Ahrefs.com trial

The email came with a link to my invoice as well as a subscription manager, where I could modify or cancel my payment.

Paddle - what the customer sees

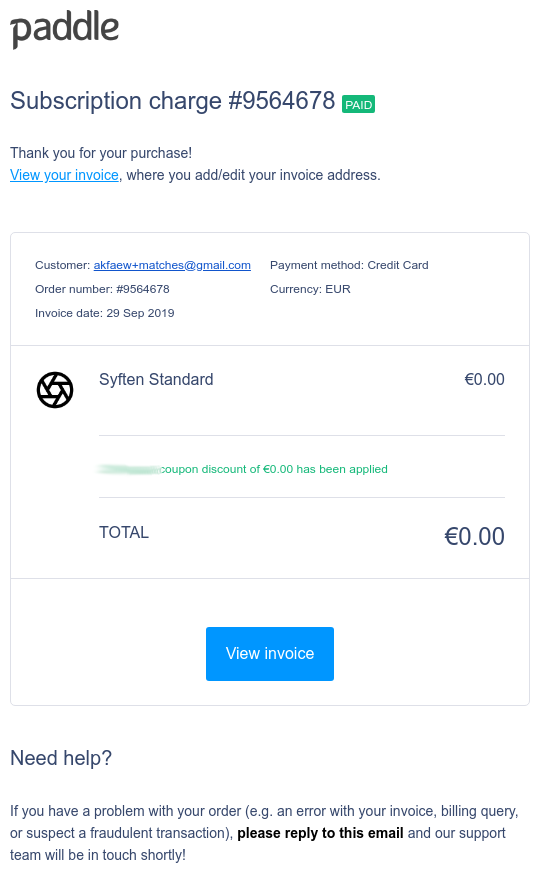

I use Paddle for my products. When testing payments for Syften I got this email:

What I saw when I was testing payments for Syften

What I saw when I was testing payments for Syften

It also comes with a link to my invoice. However, they do not have a subscription manager. I either have to change my order through the vendor’s website or email support.

Business considerations

FastSpring charges either 5.9% + $0.95 per transaction or a flat 8.9% per transaction with a minimum fee of 75 cents. Paddle charges 5% + $0.50. But there is a more important question. Remember, you don’t have any customers - your merchant of record does. So what happens when you want to switch?

There was a discussion on SaaS Growth Hacks where it came out that FastSpring is a lock-in service, meaning that they won’t share the customer data with you:

You can’t move subscription data from FS to another payment processor.

I inquired, and got this reply:

subscription migration capabilities are really up to the provider you would be potentially moving too from FastSpring. But we would not stop any sort of data migration from the FastSpring side.

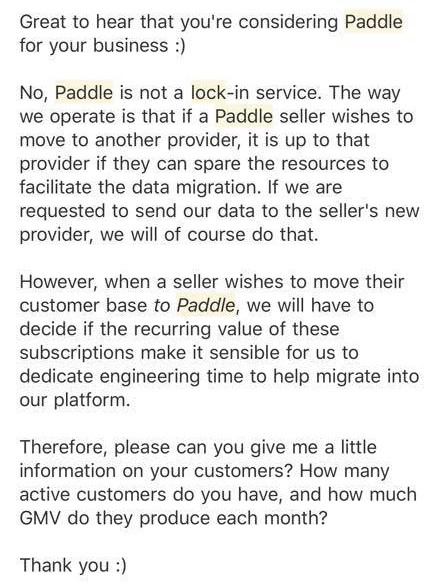

With Paddle, one user got this reply:

Reply from Paddle

Reply from Paddle

FastSpring has a more corporate vibe. To sign up you’ll have to go through a little back-and-forth with a Sr. Sales Conversion Representative, or someone like that, who will guide you through their “sales funnel”. Users who post negative reviews online are asked to contact reviews@fastspring.com, which only adds to their corporate appearance. Ahrefs is a notable FastSpring customer.

Paddle on the other hand has a very startup-ish vibe. When contacting support you’ll talk to a real human who’s allowed to speak freely, as opposed to following procedures. Paddle is the number one choice for indie hackers and bootstrappers.

Start With Paddle

Are you bootstrapping a SaaS? Then start with Paddle - it’s cheaper and more popular. And if you change your mind later just export your data and migrate to a different service.

That’s not to say it’s perfect. As one user on Facebook accurately put it:

We use Paddle. They seem to do fine at processing cards and paying out the money owed.

Everything else sucks.

So before you sign up please read about all the different problems with Paddle.